What is Tabby & A Complete Guide to Buy Now, Pay Later App

In the UAE and KSA the shopping culture is being revolutionized for customers with the Buy Now, Pay Later (BNPL) model of payment. To have a flexible payment plan for shoppers there have emerged a lot of apps that provide this service. Among them, the top most used and liked one is Tabby. With the Tabby app users can split their purchases into interest-free instalments and this makes shopping even more convenient for budget-friendly consumers.

Tabby has made a pivoting role in the expansion of consumer behaviour in retail sales in the Middle East, the BNPL market has been growing along with the increased customers for online shopping. In this blog let us find out what Tabby is, how it works, its benefits and how it is better when compared to competitors like Tamara.

What is Tabby App?

One name that has been reshaping consumer behavior in this digital finance world is Tabby. So, what is the Tabby app? It is a leading Buy Now Pay Later (BNPL) solution that is operating across the UAE, Saudi Arabia and the GCC region. It gives the shoppers a power-up to purchase instantly and split the payment into four interest-free installments. This makes a budgeting tool and retail enabler. This App is designed for the mobile-first generation, The Tabby shopping app is easily integrated with hundreds of top e-commerce platforms, from electronics, fashion, beauty and lifestyle brands.

For shoppers, the Tabby app brings flexibility and cost freedom without the weight of credit card interest or surprise fees. Once a debit or credit card is connected, customers can shop with allied merchants, choose Tabby in checkout, and split the cost into affordable payments, opening up premium purchases to more people. This clean and effective experience has put Tabby in the limelight as one of the most consumer-focused fintech apps in the region.

Behind the scenes, the Tabby development app is integrated with AI-driven credit risk analysis, smart payment automation, and real-time fraud detection. This ensures a secure and reliable payment experience for customers and merchants alike. For businesses that are into Buy Now Pay Later apps like Tabby leads to increased conversion rates, higher order values, and strong customer loyalty. This is the reason why many brands, and even developers, are actively exploring how to develop an app like Tabby that offer similar financial flexibility with their own digital ecosystem.

Tabby’s increasing demand illustrates a larger trend in how consumers understand affordability and checkout ease. For fintech startups and developers, creating a Tabby development app is a huge chance to capture the exploding BNPL market in the Middle East. By providing adjustable APIs and a seamless UX, Tabby is setting a standard for financial technology innovation in MENA.

How Tabby Works

Tabby gives an easy and simple Buy Now, Pay Later experience for online and offline consumers. And here is how it works,

- Sign Up: By providing users mobile number, Emirates ID (UAE) or Iqama (KSA) can register on the Tabby app or website and link a valid payment method.

- Shop at Partner Stores: Consumers can shop with all major leading brands as Tabby is integrated with all regional retailers.

- Choose Tabby at Checkout: The bill can be split into four interest-free instalments when the users select the Tabby payment option on the payment page.

- Make the First Payment: The first instalment is deducted immediately, while the remaining three are scheduled over six weeks.

- Repayment & Reminders: The Tabby app sends due date reminders, ensuring users stay on track with their payments.

The Tabby card also has a feature that simplifies transactions which allows customers to shop from any stores that accept Mastercard and later repay through the app.

Tabby: Features, Benefits, and the Role of a Mobile App Development Company

Tabby provides consumers a convenient, interest-free payment option where shoppers can shop without additional fees or high credit card interest. The shopping convenience allows customers to split purchases into convenient installments and this makes the premium products affordable to all.

With instant approval and reduced paperwork, Tabby eliminates the inconvenience of long credit checks, bringing users fast and easy access to its services. Additionally, its extensive partnerships with both offline and online retailers allow for very extensive acceptability across industries.

Security and money management are the key to Tabby’s services. The platform has encrypted payments and a strong verification process to protect customer information and transactions. With spending reports and payment reminders, Tabby helps users to manage their expenses and have financial flexibility for shoppers and retailers.

The Role of a Mobile App Development Company in Creating BNPL Apps Like Tabby

If you are looking to build a Buy Now, Pay Later (BNPL) app like Tabby, one of the important things to consider is to collaborate with a leading mobile app development company in Dubai. Nuox Technologies is one of the best mobile app development companies whose expertise is in developing high-quality, customized financial apps that are designed to adhere to global standards.

Nuox technologies provide a complete solution from ideation and design to development and post-launch assistance. With innovative and advanced technologies, Nuox has secure, scalable, and feature-filled BNPL apps that focus on enhancing user experience and promote business growth.

By opting for Nuox Technologies, companies can build cutting-edge BNPL solutions to meet the needs of the shifting digital finance scenario, providing effortless and flexible payment alternatives to customers in the UAE and beyond.

How Much Does It Cost to Build a Buy Now, Pay Later App Like Tabby?

Different factors affect the cost to build a Buy Now, Pay Later (BNPL) app like Tabby. Some key elements like features, security requirements, design complexities, and compliance with financial regulations are to be taken into consideration. An estimated cost to build a BNPL app in the UAE can range between $40,000 – $150,000, depending on the app’s functionalities and scale.

How to use Tabby

The Tabby card is a game-changer for BNPL users in the UAE and KSA. Here’s everything you need to know:

How to Get a Tabby Card

- Download the Tabby App: Sign in or create an account.

- Apply for the Card: Submit the necessary details and get approval within minutes.

- Activate & Use: Once approved, the virtual Tabby card can be added to Apple Pay or Google Pay for seamless in-store and online transactions.

How Tabby Cards Work

- The Tabby card functions like a prepaid credit card but follows the BNPL model.

- Users can shop at any Mastercard-accepting store, splitting payments into instalments.

- Payments are managed through the Tabby app, where users can track spending and due dates.

Tabby vs. Tamara: What’s the Difference?

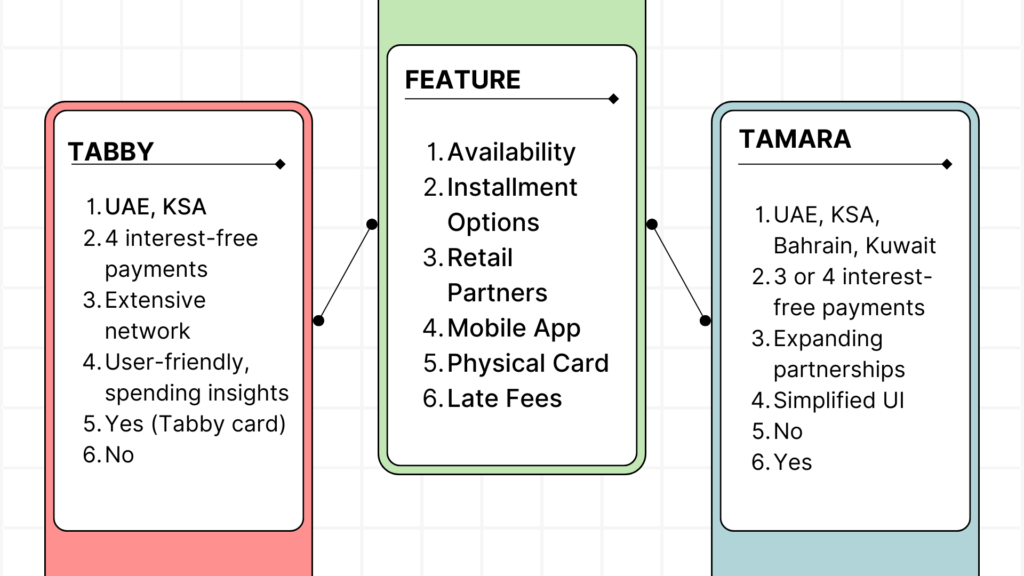

While Tabby and Tamara are both leading BNPL providers in the region, they have key differences:

Tabby App & Payment Management

Managing the BNPL payment can be a bit of a challenge, but Tabby makes it easier with its user-friendly app. And the app offers:

- Transaction Tracking: Users can view pending and completed payments in one dashboard.

- Payment Reminders: Automated alerts help users avoid missed payments.

- Easy Rescheduling: If needed, users can adjust payment dates within certain limits.

- Customer Support: 24/7 assistance for troubleshooting payment issues.

If a payment is missed, Tabby does not charge late fees, unlike other BNPL providers. However, repeated missed payments may result in account suspension.

Industry Impact & Consumer Trends

The growth of BNPL solutions such as Tabby UAE is heavily influencing the behaviour of consumers, particularly young consumers who are keen on convenience and flexibility when it comes to finances. Growth in e-commerce is one of the main reasons for this movement, as the adoption of BNPL leads to increased online buying, with higher-value items made more affordable without the immediate need for cash outlay. The Middle East region is particularly resilient in this regard, with digital payment options taking up pace rapidly. Moreover, financial inclusion is increasing, enabling consumers who do not have access to conventional credit cards to purchase with more confidence.

For merchants, BNPL offerings such as Tabby payment are fast becoming a game-changer with improved conversion rates, more sales, and greater customer retention. Companies that accept Tabby payments see a larger customer base because consumers are inclined to make purchases when provided with flexible payment options. With the BNPL industry on a rapid expansion track, it is revolutionizing the retail scene through increased customer shopping behaviour and increased merchant profitability.

Why Element8 is the Best Mobile App Development Company in Saudi Arabia

The demand for secure and user-friendly fintech solutions is on the rise and Tabby is one of the successful examples. If you are looking to develop a BNPL app like Tabby, you have Element8- the best choice in Saudi Arabia for mobile app development.

Element8 stands as the leading fintech app development company with expertise in developing secure and scalable payment solutions, with customized BNPL platforms that meet the specific requirements of businesses, Element8 is the right choice for businesses looking to enter or expand within the BNPL market.

Conclusion

Tabby is a game-changer in the UAE and KSA’s BNPL sector, offering consumers interest-free shopping flexibility while helping retailers boost sales. With its easy instalment process, Tabby card, and strong market presence, it continues to dominate the BNPL space. As the demand for digital payments grows, Tabby UAE is set to shape the future of shopping in the region.

FAQs

- How can I sign up for Tabby?

You can sign up through the Tabby app by providing your mobile number, Emirates ID (UAE) or Iqama (KSA), and linking a valid payment method.

- How to get a Tabby card?

Apply through the Tabby app, get instant approval, and start using the virtual card immediately for online and in-store purchases.

- Does Tabby have late fees?

No, Tabby does not charge late fees, making it a customer-friendly BNPL option.

- Where can I use Tabby payments?

Tabby is accepted at major online and offline retailers across the UAE and KSA.

- Can businesses integrate Tabby into their payment systems?

Yes, businesses can partner with Tabby UAE to offer BNPL options at checkout, boosting sales and customer satisfaction.