How to Develop A Split Payments App Like Tamara

You must have been in those existential crisis situations where you are pondering all of your life’s choices over splitting a bill with friends or colleagues. Haven’t you? Well, you are not alone. The uptick in apps that help split money supports the ire. Tamara UAE is a testimony to the fact that how more and more people need an ounce of help in managing their shared expenses. Consequently, this is a booming market; if you happen to be someone who would like to take advantage of this market, then you have come to the right place. We shall delve deeper in this blog on how one can develop an application like Tamara Payment UAE and also how you can build one.

How Do Split Payment Apps Work?

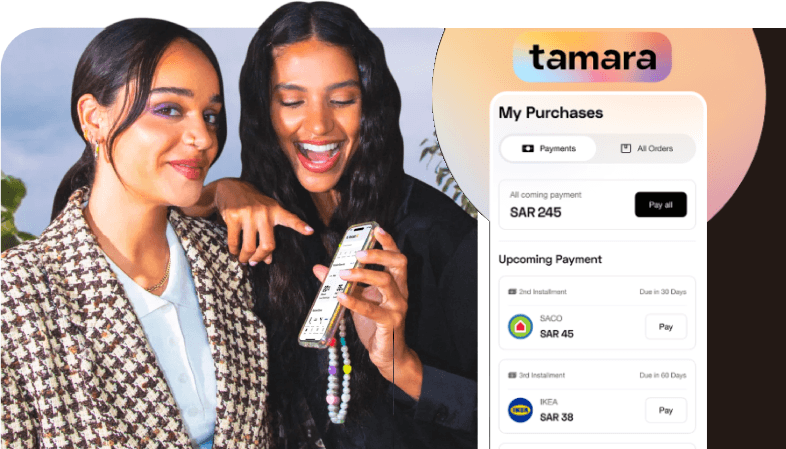

It has in-built split payment applications, making transactions complicated between a group of people at one go. Be it dinner, rent, or travel expenses, be it a group chipping in together for a gift, these apps put everyone at ease while paying their fair share. Tamara app emerged to be the leader in this market of Buy Now Pay Later app (BNPL) and service provider firms to dominate Middle East. Processing millions of dollars in transactions daily with over 3 million active users, Tamara has been the centrepiece of scrutiny while developing an app for split payments.

Key Features of a Split Payment App:

Development of a split payment application requires some features to be taken care of for user satisfaction and functionality in a seamless way.

User Requirements & Development :

User Registration and Authentication:

Secure registration and login of users shall be ensured. Integration with all of the major payment gateways like PayPal, Stripe, or Braintree should be done to ensure seamless and secure transactions of Tamara installment.

Payment Splitting Functionality:

Easy splitting of payments. Construct transaction history—keeping a detailed log of all the transactions—one can ensure greater transparency. Notifications and alerts to the users in regard to payment status and reminders; rigorous security features with strong encryption and following financial regulations; in-app options for customer support to help users.

Technical Requirements & Development

The split payment app requires a strong technical framework against the tough functioning of the application.

Frontend Development:

The development of Native Apps by using Kotlin for Android and Swift for iOS, or cross-platform development with React Native/Flutter.

Backend Development:

Protection through robust back-end support is provided by these frameworks. It is offered via Django, Ruby on Rails, or Node.js.

Server Hosting:

Consider cloud services like AWS, Google Cloud, or Microsoft Azure.

Database:

PostgreSQL, MySQL, or MongoDB for reliable data storage.

Security:

SSL/TLS for data encryption and two-factor authentication

APIs & Integrations:

Integrate with payment gateways, WebSockets for real-time communication, and Google Analytics or Mixpanel for analytics tools

Design Requirements & Development

The application success further lies at the user-friendliness of the application, which is insured through the following.

UI/UX Principles:

Clean design so that the user must be able to understand intuitively.

Wireframe and prototype the user flow and layout of your app before writing a single line of code.

Gather user feedback Test real users and implement the required changes.

Legal Requirements & Development

The app shall at all costs adhere to all the concerned legal compliances to avoid any sort of legal hassle in the future.

Financial Regulations:

The concerned application will be bound by regional financial laws

Data Privacy — The subject app will follow GDPR, CCPA, etc.

Terms of Service and Privacy Policy:

Clearly draft all the legal documents that will be required to protect both your company and users.

How Much does It Cost to Develop a Split Payment App like Tamara?

Tamara UAE-like app development cost relies on multiple factors, including:

Development Complexity:

More features and higher complexity raise expenses.

Geographic Location of the Development Team:

There are big differences in the prices across regions.

Integration with Retail Partners:

Integration with multiple partners via APIs increases the cost.

Infrastructure setup at the backend and Server costs:

Setting up robust infrastructure to achieve high performance and scalabilities.

Ongoing Maintenance and Support:

To ensure regular updates with bug fixes and customer support, a dedicated resource is essential.

Marketing and User Acquisition:

Effective marketing strategies have to be implemented to bring more users.

Therefore, the development cost of a split payment app like Tamara Payment UAE will be approximated to be around USD 30,000 to USD 300,000.

What are the Challenges of Developing an App like Tamara?

Development of a large-scale split payment app has its own set of challenges.

Technical Challenges:

The technical ones include the fact that it requires robust architecture to handle multiple features.

Market Competition:

Regarding market competition, differentiation has to be inducted into your split payment app with unique features and excellent user experience.

User Adoption:

Focus on user acquisition and retention marketing strategies.

Tips to Launch & Market a Split Payment like Tamera:

To successfully launch your application you need to create the following:

Pre-Launch Checklist:

Make sure everything is well-tested and ready.

Marketing Strategies:

Utilize SEO, PPC, and social media for app promotion.

User Acquisition and Retention:

Engage users through captivating features and world-class customer support.

What are the future Trends in Split Payment Applications?

Keeping an eye on the tangent of technological development and user expectation, we can expect the following trends emerging in the split payment application sector:

AI and Blockchain:

These technologies would be harnessed to live up their potential of strengthening the security and user experience of the payment circuit.

Evolving User Expectations:

Keep updating with user preferences and market trends.

Sustainability and Growth:

Concentrate on long-term strategies for gradual improvement and growth.

Bottom line:

Developing an application for split payment like Tamara Payment needs agile planning so that it may turn out to be a rewarding and incentivizing venture.

By understanding the earmarking of essential features, one will be better placed to understand the technical demands and the expenditure of the application development that will help meet both—user demand and the market competition.

App Development with Element8

If you are all set to bring this vision of yours out in the world, then we are the tech team with whom you want to share this vision. Element8 Saudi Arabia stands at the very pinnacle of futuristic ventures and at the absolute forefront of digital innovations brimming from Middle East and reaching worldwide.

With an insanely impressive track record that has been proven in terms of developing secure and scalable FinTech solutions. This tebuka astute observation, research-based, learned insight into the regional market, coupled with state-of-the-art technologies like AI and blockchain expertise, will ensure that your application meets and goes beyond industrial standards.

With Element8 for app development in Saudi Arabia, you choose a dedicated team committed to delivering the finest end-to-end support, from concept to post-launch. That is to say, from the very beginning of conceptualization up until post-launch support, we will stand with you like a rock throughout the process and support you until this very tech wonder that we have co-developed comes out for the world to see.

The best part? We will make sure developing a split payment app does not break your own bank!

So choose Element8 Saudi Arabia for your next fintech app development venture and let’s talk ideas.

What’s stopping you?